Mercury Turns Up the Heat on Brex and Ramp with New Financial Software Suite

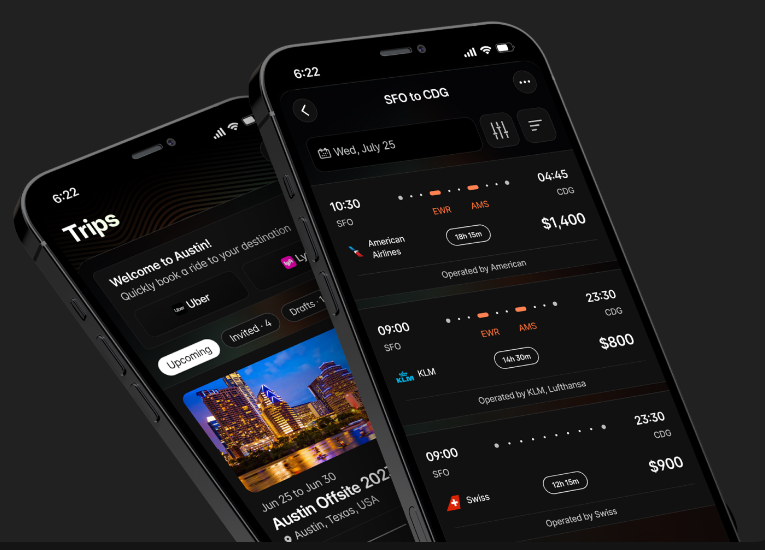

The neobank darling of startups, Mercury, is making a bold move into the competitive world of spend management software, directly challenging fintech giants like Brex and Ramp. This strategic expansion, announced exclusively to TechCrunch, introduces a suite of integrated tools designed to streamline financial operations for businesses of all sizes.

Here’s how Mercury is shaking up the fintech landscape:

1. A One-Stop Shop for Financial Management: Mercury is moving beyond its core banking services to offer a comprehensive platform that addresses a wider range of financial needs. This includes:

- Advanced Bill Pay: Automated bill processing with AI-powered features like bill detail population and duplicate detection. Mobile and Slack integration streamlines approvals for a seamless workflow.

- Accounting Automation: Seamless integration with popular accounting software like NetSuite ensures real-time synchronization of bills and expenses, simplifying bookkeeping and financial reporting.

- Invoicing and Reimbursements: (Launching Summer 2024) Create professional invoices, accept payments via credit card or ACH, and automate reminders. Set up reimbursement policies and track employee spending with ease.

2. Targeting a Broader Market: While initially focused on startups, Mercury’s customer base has diversified significantly. Now, less than 40% of its customers are startups, with e-commerce businesses representing the second largest segment. This expansion into software solutions caters to the evolving needs of this broader clientele.

3. Competitive Pricing: Access to the new workflows is free until August 1st, 2024. After that, Mercury will offer tiered pricing plans ranging from $35 to $350 per month, based on company size and feature requirements. This competitive pricing strategy aims to attract businesses looking for affordable yet powerful solutions.

4. Building on Existing Strengths: Mercury processes over $4 billion in outgoing payments monthly for its 200,000+ customers. This existing transaction volume, coupled with its reputation for user-friendly banking services, positions the company well to integrate and scale these new software offerings.

5. Addressing a Growing Need: As businesses mature, they require more sophisticated tools to manage their finances. Mercury’s expansion into spend management software directly addresses this need, providing a compelling alternative to standalone solutions.

Mercury’s move into the software arena is a significant development in the fintech industry. It signals a shift towards integrated platforms that cater to the holistic financial needs of businesses. While the competition is fierce, Mercury’s established customer base, competitive pricing, and focus on user experience give it a strong foundation for success.

Here’s a deeper dive into the key features and implications of Mercury’s new software suite:

Table: Mercury’s New Software Features

| Feature | Description | Benefits |

|---|---|---|

| Advanced Bill Pay | AI-powered bill processing, duplicate detection, mobile and Slack approvals | Streamlined workflows, reduced errors, improved efficiency |

| Accounting Automation | Real-time synchronization with accounting software like NetSuite | Simplified bookkeeping, accurate financial reporting, time savings |

| Invoicing | Professional invoice creation, credit card and ACH payments, automated reminders | Improved cash flow, reduced administrative burden |

| Reimbursements | Customizable reimbursement policies, spend tracking, streamlined approvals | Increased employee satisfaction, better expense control |

FAQs about Mercury’s New Software Offering:

Q: How does Mercury’s new software compare to competitors like Brex and Ramp?

A: While Brex and Ramp offer similar features, Mercury differentiates itself through its integrated banking platform, competitive pricing, and focus on a broader customer base beyond just startups.

Q: Is Mercury’s software suitable for small businesses?

A: Yes, Mercury’s tiered pricing plans make its software accessible to businesses of all sizes, from small startups to larger enterprises.

Q: What are the benefits of using an integrated platform like Mercury for financial management?

A: An integrated platform streamlines financial operations, reduces manual work, improves accuracy, and provides a holistic view of business finances.

Q: How does Mercury’s expansion into software impact its core banking services?

A: The software expansion complements Mercury’s existing banking services, offering a more comprehensive and valuable solution for its customers.

Q: What is the future outlook for Mercury in the fintech landscape?

A: Mercury’s strategic move into software positions it as a formidable player in the evolving fintech industry, with the potential to capture a significant market share.

This strategic expansion by Mercury has the potential to reshape the fintech landscape. It will be interesting to see how competitors respond and how this move impacts the broader adoption of integrated financial management platforms.

External Resources:

- TechCrunch: https://techcrunch.com/

- Mercury: https://mercury.com/

- Brex: https://brex.com/

- Ramp: https://ramp.com/